The Collapse of Consumer Energy Solutions

Systemic Failure Hidden in Plain Sight

On 9 January 2026, Consumer Energy Solutions Ltd (CES) – one of the UK’s largest installers operating under the Government’s ECO4 energy-efficiency scheme – entered administration and ceased trading with immediate effect. Over 700 employees were reported in 2024. Of these, a significant number of self-employed contractors carried out works under CES branding. We are sincerely sorry to hear of all job losses, irrespective of wider concerns.

This article digs deeper into the history, financials, and governance of CES, whilst revealing how a failed system of oversight enabled their rapid rise and sudden fall. We note the revelations of the recent NAO report are limited in scope and call on policymakers to conduct a comprehensive review of ECO4 and to ensure the lives of those affected are now a matter of priority. The article below expresses systemic concerns that extend far beyond the administration of CES. The wider issues discussed do not address CES specifically unless explicit.

Founded in 2016, CES expanded rapidly during a period in which retrofit policy has prioritised speed and numbers over efficacy. Its collapse has left many households with unfinished or defective work. Some households report life-altering consequences – for better or for worse.

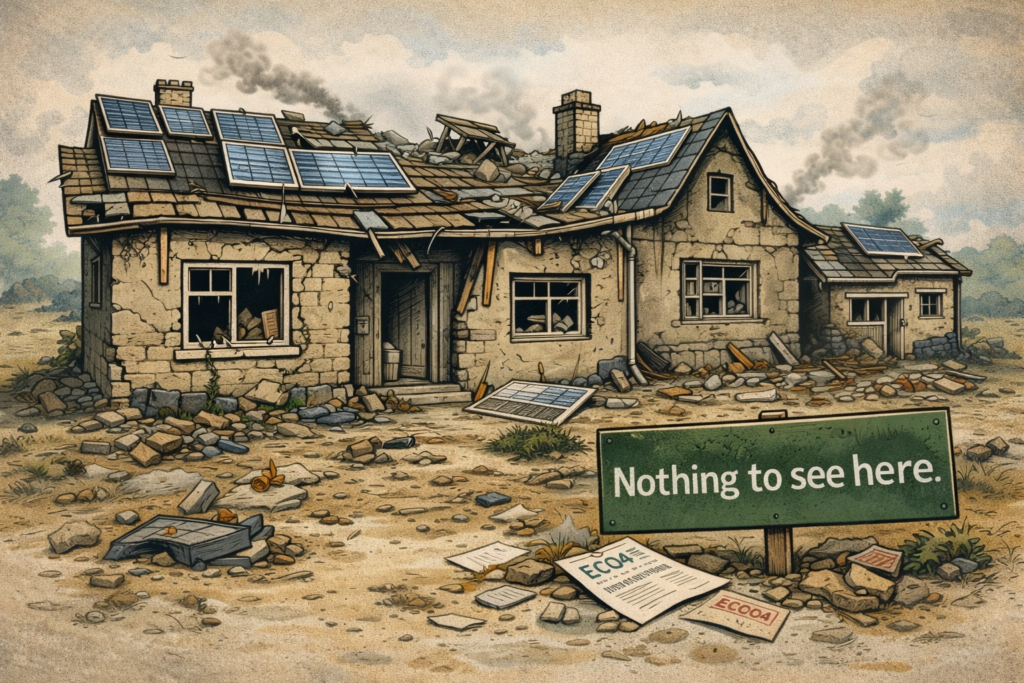

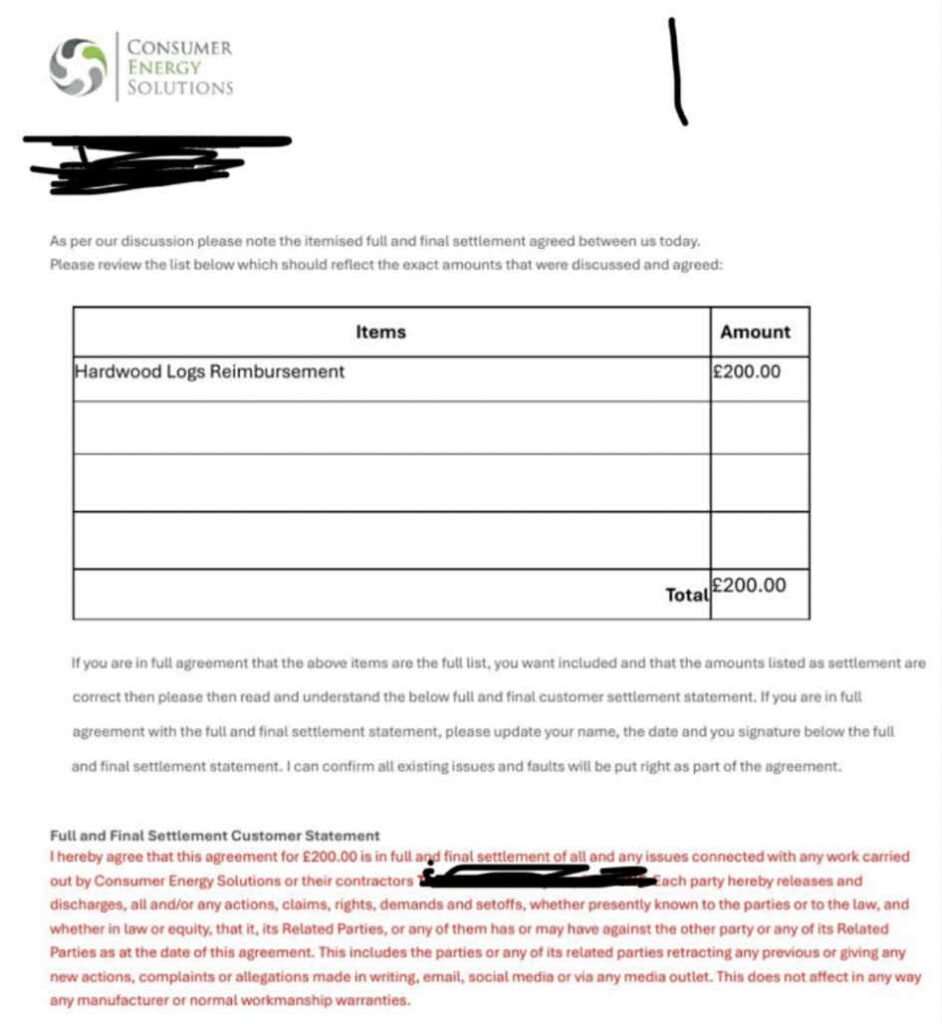

One homeowner with whom we are in contact felt forced to sell their home after the devastating impact of a CES install. Another was moved into a care home pending restoration of their heating. And another family with an ill child claims to have been temporarily rehoused by their local authority. Others have been left without functional heat during Winter – some for months. Others have reported higher bills as a result of inappropriate or poorly-designed heat pumps. And, Nature Society has received evidence of a ‘full and final’ settlement sent to one customer in exchange for a £200 delivery of logs, when left without heating for several weeks of Autumn. This, a household in which lives an Immunosuppressed person.

The ECO4 scheme targets those who are often-vulnerable and on benefits or low incomes. S4C and ITV Wales have previously exposed the standard of works some CES customers have experienced, including those who are vulnerable. A further article can be found here.

We acknowledge many installs are also reported to be successful. However, success has often depended on the skills and motivations of 3rd-party install teams contracted to works and whether the property was truly appropriate for works prescribed. When things have gone wrong, concerns have been widely reported as to the proper handling of complaints.

The collapse of CES goes beyond the misalignment of profit-centric capitalism and social enterprise. The government themselves deem ECO4 to embody ‘systemic failure’.

Liz Saville Roberts MP states:

“I am very passionate for the vulnerable people who have come to my office following unsuitable heating/insulation proposals, faulty work and shoddy remedial measures. By a country mile, CES remains the single worst installer in terms of the numbers of complaints.”

Public Money, Homeowner Risk

Despite the sales patter, ECO4 is not “free money.” Not in any sense.

These monies are funded by energy bill payers, via levies in domestic bills, under the oversight of the Department for Energy Security and Net Zero (DESNZ) and a fragmented and largely ineffective network of regulators, scheme administrators, and assurance bodies.

Over the last four years, every UK household is estimated to have contributed up to £200 toward ECO obligations – whether or not they received any ECO4 ‘measures’; ranging from ‘low risk’ loft insulation, to higher risk solid wall insulation and Air Source Heat Pumps.

“Free” has all-too often been used for cost-cutting and margin boosting. Corners have been cut which are less common under the ‘Boiler Upgrade Scheme’. Misrepresentation and mis-selling have also been widely reported, supported by a ‘lead generation’ industry, in which India, Pakistan and UK-based firms are known to charge £1000+ per ‘qualified lead’. This has little to do with finding the most suitable homes for retrofit.

When delivery fails, the financial and practical risk falls overwhelmingly on the affected household. And, despite many successful installs, households are all-too-often left worse-off as a result of ECO4, whether via higher bills, damage to homes, or in the worst cases, a detrimental impact on health and wellbeing. Indeed, we believe 60 to 70,000 homes with high-risk measures, to have suffered serious near-term or latent defects during the four-year term of ECO4.

The NAO report of October 2025 also highlights the opportunity cost of retrofit when poorly implemented. For example, of the c.40,000 air source heat pumps installed, many are believed to be inappropriate or poorly designed. Despite this, there is often no hope of remediation. And, the warranties that underwrite works, last just 2 years.

The problem is not heat pumps themselves. This has been the wrong point of the ‘adoption curve’ to install immature technologies into the aging housing stock of low-income families, with no affordability checks.

Insurance-Backed Guarantees (IBGs) activate only once an installer enters administration or is dissolved. Even then, coverage is narrow, conditional, and poorly suited to systemic failures involving design, moisture risk, or whole-house performance.

Meanwhile, the PAS 2035 and MCS/MIS standards – often cited as consumer safeguards – remain weakly enforced in practice, leading some to deem ECO4 ‘the wild west of retrofit’.

Rapid Growth, Weak Oversight

The collapse of CES goes beyond concerns regarding quality, profit, and skills. They extend to a system of oversight that allows risk to fall downstream while value accumulates upstream.

For example, Ofgem has estimated that between 5,600 and 16,500 retrofit claims may have been falsified. Further misrepresentation of RdSAP / EPC data is also thought to be significant and under-forecast, together amounting to tens or hundreds of millions of pounds. Installers are paid according to the ‘Annual Bill Savings’ they generate. However, the declaration of such savings is almost entirely self-regulated, leaving less scrupulous installers to write their own cheques.

Despite this, basic fraud controls were not fully activated by Ofgem until 3.5 years into a 4-year scheme. The reporting and handling of ECO4 fraud remains complex and weakly enforced. Despite this, Ofgem and DESNZ continue to represent failed installs as a successful deployment of bill-payer monies, even where cases are in significant dispute. Alongside ABS calculations that do little to reflect real-world usage, this misrepresentation may prove material to the forecasting and claimed outcomes of the overall scheme.

Under the ECO Order 2022, DESNZ appoint Ofgem to obligate energy suppliers to fund measures. Here, grants were administered by City Energy Network Ltd, who employ inhouse ‘Retrofit Coordinators’ and appoint its sister companies, CES and Advanced Energy to deliver the works. All too often, CES customers have reported no contact with or knowledge of the role of Retrofit Coordinator, despite being in place to protect consumers under PAS2035.

Where households are in dispute and require support, this is divided between multiple bodies – none of which holds end-to-end responsibility; a paradox in light of ECO4’s ‘whole home approach’.

Jane Wallbank of South Wales states:

“The damage and destruction Consumer Energy Solutions caused isn’t contained just to properties. It extends to every aspect of their victims’ lives. CES have destroyed us physically, emotionally, and mentally. They have made tens of millions of pounds from [a government scheme designed to alleviate fuel poverty].“

Incredibly, despite the £4bn assigned to installers such as CES, and reported failure rates of up to 98% for External Wall Insulation, the scheme is now significantly over-budget, with energy suppliers demanding to be paid the balance from other publicly funded insulation schemes.

Nowhere within this £4bn is any advocacy for homeowners, who are left almost entirely unsupported. It is for this reason that Nature Society formed as an unfunded grassroots organisation.

By contrast, bodies such as TrustMark are funded by installers and the wider industry.

I have seen directly, energy companies referring to TrustMark as their sole source of quality assurance in the face of disputes, in contrast to their own clear obligations under the ECO Order.

Having been appointed in 2021, TrustMark reportedly failed to identify widespread failings until late in 2024.

When in receipt of complaints, TrustMark declare ‘no duty of care to homeowners’, fail in prioritising plight over process, and refer to a complex landscape of assurance bodies, who are often reported to fail in investigating and resolving matters in a timely manner.

Sadly, there appears little hope for the government’s ill-fated ‘Warm Homes Plan’, without fundamental reforms to the sector, which we believe should include a national retrofit body or centre of excellence, together with real-time data, and the replacement of IBGs with an insurance levy ensuring public health is protected and that no homeowner is left worse off.

A System of Unmitigated Growth

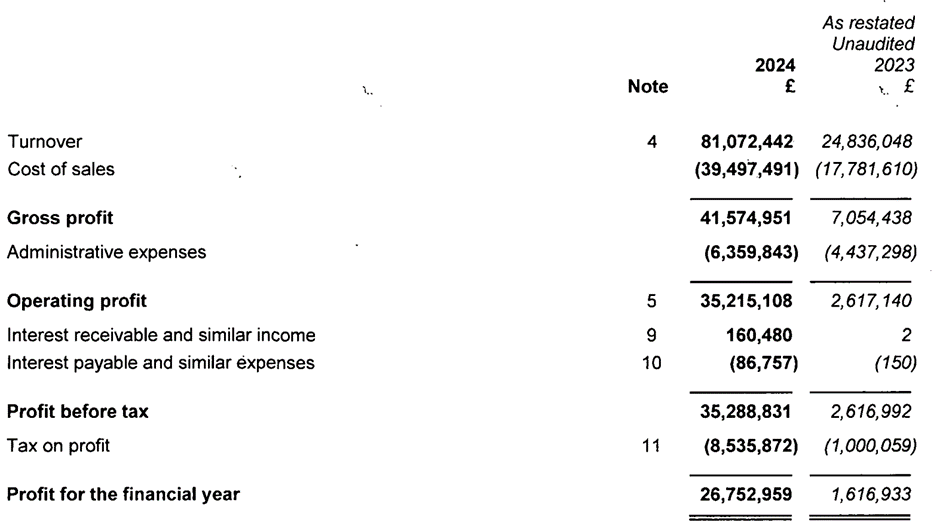

In the year to 31 January 2024, CES reported turnover of £81 million; up sharply from £24.8 million in 2023. A gross margin of approximately 51% and EBITDA of 43% was reported, resulting in pre-tax profits of c.£35m; unusually high margins for the industry.

I question how any company can endure this growth without an element of failure attached. ECO4 appears uniquely capable of enabling and celebrating such growth, rather than mitigating and distributing for social good; volume and speed over quality and accountability.

This growth appears to have been almost entirely ECO-funded.

The Group Structure Behind the Failure

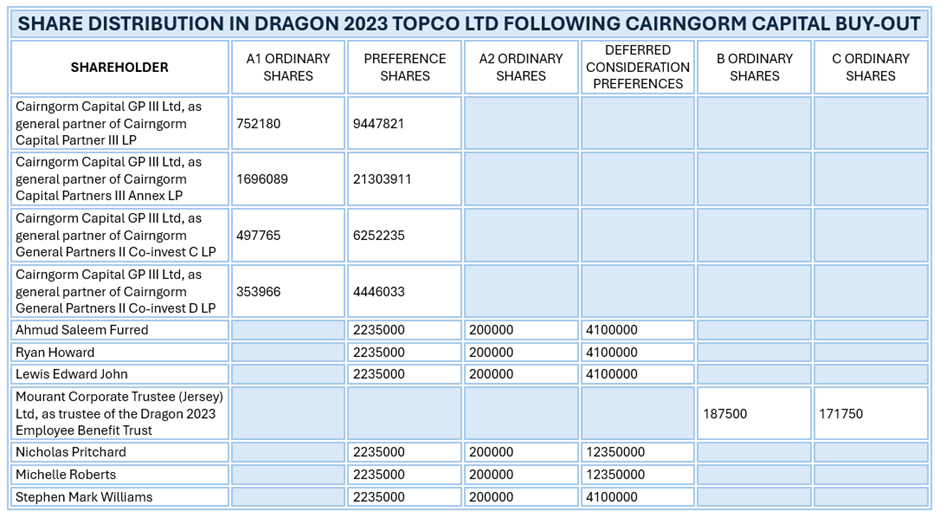

In December 2022, CES was acquired by Diversity Network Holdings Ltd, trading as City Energy Network Group. Share capital of c.£100m appears to have been issued. Thanks go to Jac o’the North for the table below:

On 8 March 2024, 100% of Diversity Network Holdings transferred to CEN Holdco Ltd, following a venture-capital acquisition by Cairngorm Capital Partners.

The corporate structure is:

- Dragon 2023 Topco Ltd – ultimate parent

- CEN Holdco Ltd – group holding company

- Diversity Network Holdings Ltd – operational holding company

- Subsidiaries:

- Consumer Energy Solutions Ltd

- City Energy Network Ltd

- City Energy Facilities Management Ltd

- Laver Group Ltd

- Advance Energy Services Ltd

- Heatforce (Wales) Ltd

- City Training Group Ltd

- Simply Electric Metering Ltd

- Associates:

- Sustainable Warmth Ltd (30 %)

- PNR Electrical Ltd (30 %)

- Community Home Solutions Ltd (37 %)

Earlier or dissolved affiliates include Net Facilities Ltd and WRYL Ltd.

CES alone are thought to account for c.half of total group revenue, according to the accounts of Diversity Network Holdings Ltd, which at the time described the group as cash-generative.

More striking, CES’s 2024 EBITDA (£35 million) exceeded the entire group’s consolidated EBITDA for 2025 (£20.7 million) by c.75%, despite CES entering administration shortly afterwards.

Taken together, the figures raise obvious questions about whether profitability was achieved by deferring delivery risk and future liabilities, rather than by building durable operational value. In fact, when you strip away ECO4, it is hard to understand where the true value of the group resides.

Topco Accounts

The Dragon 2023 Topco Ltd consolidated accounts (year ended 31 January 2025) disclose several features that merit policy attention.

First, the group’s asset base appears weak.

The majority of recorded assets consist of goodwill (£45 million) and intangibles (£86.7 million) – values that depend on continued participation in ECO4, a scheme scheduled to end in March 2026. In practical terms, much of the group’s balance-sheet value is policy-contingent and time-limited, offering little tangible security against failure.

Second, the group appears to be heavily leveraged and balance-sheet insolvent.

Total liabilities exceed total assets, leaving negative equity of approximately £82.6 million. Cash reserves stand at just £3.8 million. The auditor flags material uncertainty over going concern, citing covenant breaches, missed repayments, and reliance on continued lender support.

Third, the group recorded a loss of approximately £87.5 million in 2025, driven by large impairments and exceptional charges – an acknowledgement that previously recognised value no longer stands up.

Despite this, the group highlights “Adjusted EBITDA” as a performance measure – a metric that excludes precisely the costs now undermining solvency. The gap between adjusted metrics and economic reality is difficult to ignore.

Debt Without Assets, Value Without Accountability

The group’s reported £134 million debt appears to arise from acquisition financing, refinancing, and intra-group accounting within a private-equity structure.

CEN Holdco Ltd does not trade. Its role is to sit between lenders, investors, and operating companies. Debt is concentrated at the top of the structure; delivery risk sits below.

This helps explain how the group could appear profitable at operating level while becoming fragile and over-leveraged at the top. When a delivery company fails, lenders remain insulated, directors benefit from indemnities, and households are directed toward insurers.

Meanwhile, the former directors walked away with millions.

Administration and the Illusion of Protection

When CES entered administration, customers were directed to IBG providers such as IAA, Qualitymark, and HIES. These schemes were never designed to address systemic failure at scale. They activate late, cover narrowly, and do not remedy structural defects or design failures.

IBGs have become a substitute for effective oversight, rather than a safeguard.

What CES Leaves Behind – and the Questions It Forces

The collapse of Consumer Energy Solutions and the significant number of dissatisfied customers left behind, appears to be the foreseeable outcome of a system that:

- rewards growth without accountability

- treats quality failures as isolated incidents and non-events

- fails to provide the most basic levels of advocacy for grant recipients at any stage, and in any event

- creates a simple escape route via administration and phoenixing, in avoidance of liability

- relies on post-hoc insurance rather than preventive regulation

- Fails to account for the real-world benefits targeted by the ECO Order 2022

ECO4 was intended to reduce fuel poverty and emissions. Instead, many households have been left facing financial distress, loss of amenity, and uninhabitable homes – funded by the very bill payers the scheme was meant to help.

The question for policy-makers is unavoidable:

How was a publicly funded scheme allowed to generate extreme margins, weak assets, rising leverage, and widespread consumer harm – as visible in public filings?

Until oversight is genuinely independent, asset quality is scrutinised alongside delivery volume, and consumer protection is enforced before collapse rather than after it, this pattern will repeat itself, including into the Warm Homes Plan.

Nature Society Documents these Failures to Underline the Need fo Urgent Reforms

Oddly, for a group with wide-reaching ‘green’ and ‘environmental’ claims, its environmental impact reporting is limited to core statutory data, with little to no apparent analysis of its true impact or the efforts aligned to net zero or locally-relevant climate goals.

The group narrative centres around fuel poverty, however, we are in contact with tens of households who have reported being left without heating for sustained periods.

CES should be treated as a warning, not an exception. One with all of the tell-tale signs and one that was very much preventable. This will now be the first of a wave of installer closures under an all-too-common backdrop of the ‘pheonixing’ of ECO4 companies in avoidance of liability.

Done right, retrofit should act as a public duty that lasts for generations and over multiple tenures. DESNZ must learn fast and enact its duty of care to protect homeowners, including clear commitments made during the recent Public Accounts Committee.

Editorial note:

This article is based on publicly available filings and audited accounts. Any analysis or commentary represents the author’s interpretation of those materials and is not a finding of legal liability.

Right of Reply

Consumer Energy Solutions Ltd (“CES”), its directors, advisers, insurers, administrators, and any associated or successor entities are offered a right of reply.

Should CES, its appointed administrators, or any properly authorised representative wish to respond to the specific issues set out — including matters of installation quality, regulatory compliance, governance, or financial reporting — their response will be considered for publication in full, subject only to standard editorial checks for relevance, accuracy, and lawfulness.

This article is based on documentary evidence, published accounts, regulatory findings, contemporaneous correspondence, firsthand experience, and the testimonies of those affected, and has been written in the public interest. Nothing herein is intended to pre-judge the outcome of any ongoing regulatory, insurance, insolvency, or legal process.